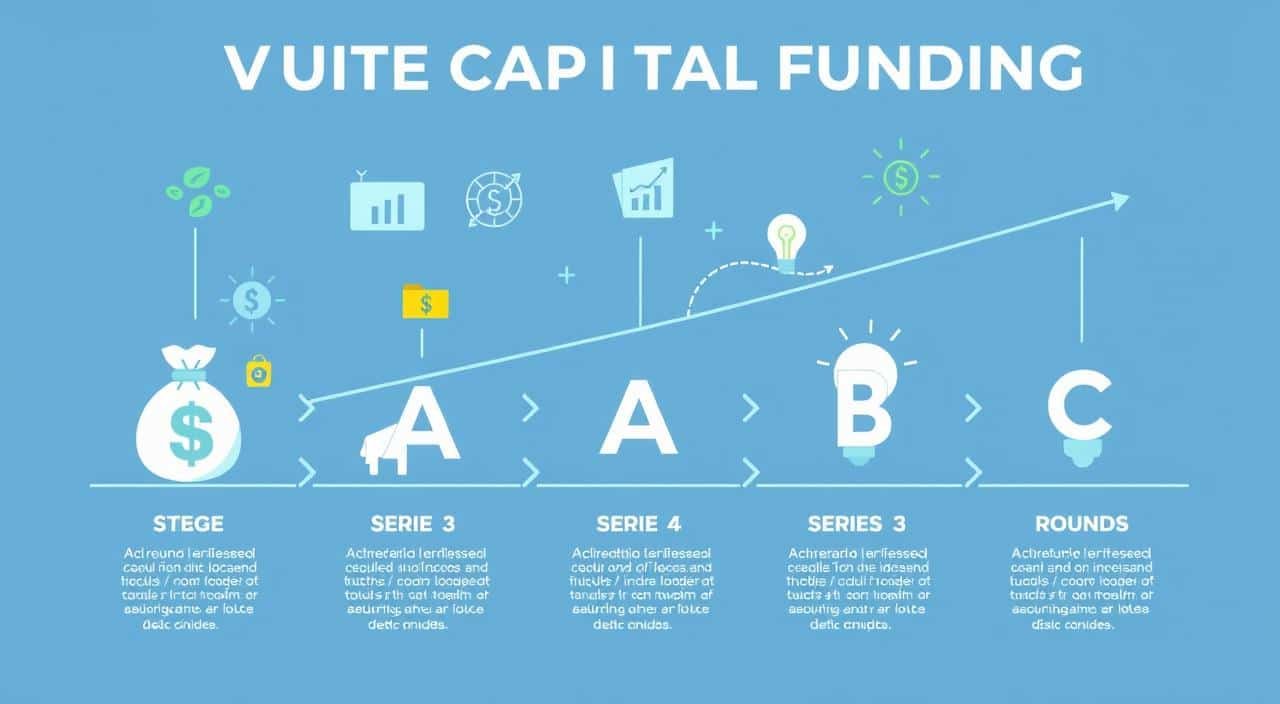

Starting a business and getting venture capital funding is a big step. It helps startups grow and expand. Venture capital funding has different stages, like pre-seed, seed, Series A, B, C, and sometimes D. Each stage shows how mature the company is and how much risk investors are taking.

Venture capital firms use money from many investors to support growing companies. These investors include rich people, pension funds, and endowments. In return, VCs get a share of the company’s ownership. Knowing the stages of VC funding is key for founders. It helps them plan their fundraising and find the right investors.

Key Takeaways

- Venture capital funding follows a series of stages, including pre-seed, seed, Series A, B, C, and sometimes D rounds.

- Each stage represents a different level of company maturity and investor risk tolerance.

- VCs invest in exchange for an equity or ownership stake in the company.

- Understanding the funding stages helps founders plan their fundraising journey and target appropriate investors.

- The time between seed and Series A stages typically takes 12-18 months, but can vary.

Understanding Venture Capital: Investment Basics

Venture capital is a special kind of funding. It brings together money from many sources like venture capitalists and private equity firms. These investors help new companies and startups grow by giving them money and valuable advice.

Key Players in Venture Capital Funding

The main players in venture capital are:

- Venture Capitalists (VCs): These are professional investors who manage funds. They look for promising startups to invest in and help them grow.

- Angel Investors: These are wealthy people who give money to startups early on. They usually want a share of the company in return.

- Limited Partners (LPs): These are big investors who give money to venture capital firms. They help fund startups.

- General Partners (GPs): The team that runs the venture capital firm. They find, evaluate, and invest in startups.

The Role of Venture Capitalists in Startup Growth

Venture capitalists are key in helping startups grow. They give money and advice. They also use their big networks to help startups.

Venture capitalists need to make a lot of money from their investments. They often work closely with the companies they invest in. They help with strategy and sit on boards.

Risk and Return in Venture Investments

Investments in venture capital are very risky but can be very rewarding. More than 75% of startups backed by venture capital fail. But, the ones that succeed can make a lot of money.

Venture capitalists look for a few special startups. Only 5-7% of their investments make most of the money.

“Venture capitalists play a pivotal role in funding entrepreneurs and innovation, acting as a trail-wise sidekick to the modern-day cowboy entrepreneur.”

Pre-Seed and Seed Stage Funding

The journey of venture capital funding for startups starts with the pre-seed and seed stages. Bootstrapping, or using personal resources, is common in the pre-seed phase. Companies use personal savings, friends, family, and early-stage funds (also known as micro VCs) to get started.

The seed stage shows a startup’s potential for growth. Seed funding helps with market research, refining business plans, and building teams. Investors include founders, angel investors, and early venture capital firms. Seed-stage valuations are usually under $1 million to $10 million, with funding from $100,000 to $1 million.

| Pre-Seed Funding | Seed Funding |

|---|---|

|

|

The pre-seed and seed stages are key for startups to grow. They help establish the company, validate the market, and prepare for the next big step: Series A. By using these early-stage bootstrapping and seed capital options, entrepreneurs can set their ventures up for success.

Series A: The First Major Venture Capital Round

Startups move from seed funding to the Series A round next. This is the first big venture capital investment, usually between $2 million and $15 million. At this point, companies need to show they have a good product-market fit, steady revenue growth, and a clear path to making money in the long run to get venture capital financing.

Requirements for Series A Funding

To get a successful Series A round, startups need to meet several important criteria:

- Refined product or service offering

- Expanded workforce to support growth

- Detailed business plan outlining long-term profitability

- Proven customer demand and market traction

Typical Valuations and Investment Amounts

Series A rounds usually see investments from $2 million to $15 million. The average valuation is between $10 million and $15 million. But, in fields like pharmaceuticals, semiconductors, or real estate, Series A rounds can go over $10 million.

Key Milestones and Expectations

Startups in the Series A stage should focus on several key goals:

- Driving customer growth and acquisition

- Refining and enhancing their products or services

- Preparing to scale their operations and workforce

- Building robust marketing and advertising efforts

Venture capitalists at this stage help guide the company’s growth. They use their knowledge and networks to help the startup succeed.

Series B and C: Growth and Expansion Phases

Startups move into the growth and expansion phases with Series B and Series C funding. These investments are key for scaling operations and expanding markets. They help businesses become leaders in their industries.

The Series B stage supports product manufacturing, marketing, and sales growth. Companies need to show they have a working product. In 2023, Series B valuations averaged around $100 million, with a median of $28 million.

After Series B, Series C and later funding fuels rapid growth. Companies are established, with solid revenues and market share. Investors include late-stage venture capitalists, hedge funds, banks, and private equity firms. Series C valuations can reach $100-200 million, with a 2023 median of $42 million. These investments are vital for expanding geographically, introducing new products, or making strategic acquisitions.

| Funding Stage | Average Valuation | Median Funding | Key Focus Areas |

|---|---|---|---|

| Series B | $100 million | $28 million | Product manufacturing, marketing, and sales operations expansion |

| Series C | $100-200 million | $42 million | Aggressive growth initiatives, geographic expansion, new product lines, strategic acquisitions |

The main goals in these phases are to scale operations and expand the market. Companies aim to attract a variety of late-stage venture capital and hedge fund investors. This helps them continue to grow and succeed.

Bridge Stage and Pre-IPO Preparation

As startups grow, they reach a bridge or mezzanine stage. This is a key time for them. They get ready for a big event, like going public or being bought by another company.

Exit Strategies and Options

Startups look at different ways to give early investors and founders money. They can either go public with an IPO or get bought. Recently, Special Purpose Acquisition Companies (SPACs) have become another option. They let startups skip the usual IPO steps.

Preparing for Public Markets

Getting ready for an IPO is a big job. Startups need a team of experts, like underwriters and lawyers. They must show their financial health and follow rules. This can take months or even years.

Late-Stage Investors and Their Role

Late-stage investors, like private equity firms, come in during the bridge stage. They give the money needed to move to public markets or a big buyout. Their help can bring valuable skills and connections for the IPO or sale.

| Funding Stage | Investment Range | Key Investors |

|---|---|---|

| Pre-Seed | $10,000 – $500,000 | Founders, friends, family, angel investors, early-stage VCs |

| Seed | $500,000 – $2 million | Angel investors, early-stage VCs |

| Series A | Significant funding | VC firms specializing in early-stage investments |

| Bridge/Mezzanine | Varies | Private equity firms, hedge funds, VCs |

Knowing about the bridge stage and pre-IPO prep helps startups. They can better understand the funding world. This sets them up for a successful exit, whether it’s an IPO or an M&A deal.

Also Read: Understanding Debt Financing: A Beginner’s Guide

Conclusion

The venture capital world has changed a lot, offering both chances and hurdles for startup founders. It’s key to know the different funding stages, from the early start to going public. This knowledge helps in making good fundraising plans and setting realistic goals.

The venture capital scene is now more competitive than ever. Many investors, old and new, want a piece of successful startups. To succeed, founders need to plan well, make smart choices, and build strong relationships with investors. This usually takes about 5.1 years.

As the startup world keeps changing, founders must find new ways to get the money they need. By keeping up with the venture capital scene, they can get the funding and support to grow and innovate. This helps them make a big impact in their fields.

FAQs

Q: What are the different stages of venture capital funding?

A: The different stages of venture capital funding typically include seed funding, early-stage funding, growth equity, and late-stage funding. Each stage corresponds to the maturity of the company and the amount of capital needed to progress.

Q: How do venture capitalists make decisions on where to invest?

A: Venture capitalists make decisions based on various factors, including the startup’s business model, market potential, team experience, and the terms of the venture capital deal proposed. They also consider the potential for high growth and return on their equity stake.

Q: What is the role of a VC firm in the funding process?

A: A VC firm acts as a pooled investment vehicle that raises capital from different investors, including insurance companies and high-net-worth individuals. The firm then invests in early-stage companies, managing a portfolio of companies to maximize returns for their limited partnership.

Q: What are angel investors, and how do they fit into the stages of venture?

A: Angel investors are individuals who provide capital to startups, usually at the seed stage. They often invest their personal funds in exchange for equity, providing not just financial support but also mentorship and networking opportunities for the entrepreneurs.

Q: How does a venture fund raise capital?

A: A venture fund raises capital by attracting new investors, including institutional investors and high-net-worth individuals, to contribute to a pooled investment. This capital is then used to invest in promising startups and high-growth companies.

Q: What is the difference between venture capital and private equity?

A: The main difference is that venture capital focuses on investing in early-stage and high-growth companies, while private equity typically invests in more mature companies that require restructuring or operational improvements. Both involve equity financing but target different stages of company development.

Q: What are portfolio companies in the context of a VC fund?

A: Portfolio companies are the startups or businesses that a venture capital fund invests in. The VC fund manages these investments, aiming to grow the companies and ultimately achieve a successful exit, such as an acquisition or IPO, to realize returns on their equity stake.

Q: What strategies do VC firms use to invest in companies?

A: VC firms employ various investment strategies, including sector-focused investing, stage-focused investing, or geographic targeting. They analyze market trends and identify opportunities to invest in companies that align with their investment thesis for growth.

Q: How does a venture capital deal typically work?

A: A venture capital deal usually involves the VC firm providing funding to a startup in exchange for an equity stake. The terms of the deal include the amount of capital, valuation of the company, and rights and obligations of both the investor and the company.

Q: What challenges do startups face when trying to raise capital?

A: Startups often face challenges such as demonstrating a viable business model, proving market demand, and competing against other startups for limited venture capital. Additionally, they need to convince investors of their potential for high growth and a strong return on investment.

Source Links

- https://www.svb.com/startup-insights/vc-relations/stages-of-venture-capital/

- https://paro.ai/blog/7-stages-of-venture-capital/

- https://hbr.org/1998/11/how-venture-capital-works

- https://www.investopedia.com/terms/v/venturecapital.asp

- https://www.brex.com/journal/pre-seed-vs-seed-funding-round-what-is-the-difference

- https://www.scalex-invest.com/blog/whats-the-difference-between-a-pre-seed-and-seed-funding-round

- https://visible.vc/blog/startup-funding-stages/

- https://www.startups.com/articles/series-funding-a-b-c-d-e

- https://en.wikipedia.org/wiki/Series_A_round

- https://www.volta.ventures/overview-of-raising-series-a-funding-venture-capital/

- https://www.investopedia.com/articles/personal-finance/102015/series-b-c-funding-what-it-all-means-and-how-it-works.asp

- https://dealroom.net/faq/funding-stages

- https://www.fe.training/free-resources/venture-capital/series-a-b-and-c-funding/

- https://eximiusvc.com/blogs/startup-funding-cycle-pre-seed-funding-to-ipo-explained/

- https://www.alehar.com/aleharx/stages-of-venture-capital-financing

- https://www.svb.com/startup-insights/vc-relations/what-is-venture-capital/

- https://www.linqto.com/blog/what-is-venture-capital/

- https://govclab.com/2023/06/14/what-is-venture-capital/