Investing in the stock market can seem intimidating, especially for beginners. Finance stocks, a crucial part of the market, offer both stability and growth opportunities. This guide breaks down the basics of finance stock investing, helping you understand the fundamentals and build a strong foundation for your financial future.

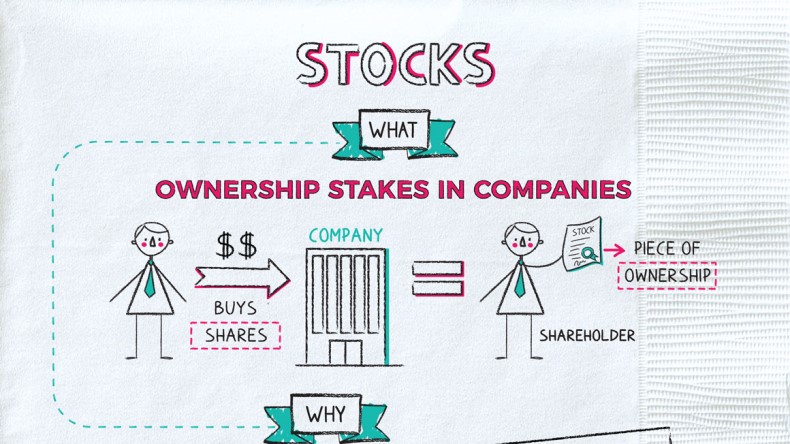

What Are Finance Stocks?

Finance stocks represent companies in the financial services industry. These include banks, investment firms, insurance companies, and real estate finance corporations. Finance stocks are essential for the economy, often seen as indicators of economic health.

Types of Finance Companies in the Stock Market

Commercial Banks

These are traditional banks offering services like savings, checking, and loans. Examples include JPMorgan Chase and Bank of America.

Investment Banks

Firms like Goldman Sachs provide services such as mergers, acquisitions, and asset management.

Insurance Companies

Companies like AIG and MetLife offer life, auto, and health insurance products.

Asset Management Firms

These companies manage investment portfolios for individuals and institutions, such as BlackRock and Vanguard.

Credit Card Companies

Visa and Mastercard are examples of financial firms profiting from transaction fees and credit services.

Why Invest in Finance Stocks?

Finance stocks often provide consistent dividends and strong long-term growth. Here are some reasons investors consider them:

1. Stability

Finance companies tend to have a consistent demand for their services, providing a level of reliability.

2. Dividend Income

Many finance stocks pay attractive dividends, offering regular income for investors.

3. Economic Growth Correlation

When the economy grows, finance companies benefit from increased loans, investments, and spending.

4. Portfolio Diversification

Adding finance stocks can balance a portfolio with tech, healthcare, or consumer goods stocks.

Key Metrics to Analyze Finance Stocks

Before investing, you should understand how to evaluate finance stocks using several financial indicators.

Price-to-Earnings (P/E) Ratio

This measures the company’s current share price relative to its earnings per share. A lower ratio could mean better value.

Return on Equity (ROE)

ROE indicates how well a company uses shareholder funds to generate profit. Finance companies with high ROE are often efficient and profitable.

Dividend Yield

Shows the annual dividend payment compared to the stock price. A higher yield can be appealing but must be sustainable.

Net Interest Margin (NIM)

Specific to banks, NIM measures the difference between interest earned and interest paid. A higher NIM means more profitability.

Capital Adequacy Ratio (CAR)

A key measure of a bank’s financial health, indicating its ability to handle financial stress.

Risks of Investing in Finance Stocks

Understanding the risks can help you make informed decisions.

Interest Rate Sensitivity

Finance stocks are highly affected by interest rate changes. Rising rates often improve profits, while falling rates can hurt margins.

Regulatory Risks

The financial industry is tightly regulated. Changes in government policies can significantly impact profitability.

Economic Downturns

During recessions, finance companies can experience increased loan defaults and lower revenues.

Credit Risk

Lending institutions face the risk of borrower defaults, which can affect earnings and stability.

How to Start Investing in Finance Stocks

Step 1: Research the Sector

Understand the different sub-sectors and business models within financial services.

Step 2: Open a Brokerage Account

Choose a reliable online broker with low fees and research tools.

Step 3: Start Small

Begin with well-known companies before moving to more speculative stocks.

Step 4: Diversify Your Holdings

Don’t put all your money in one company or sub-sector. Spread your investments to reduce risk.

Step 5: Monitor Your Investments

Track performance, news, and financial reports regularly.

Popular Finance Stocks for Beginners

JPMorgan Chase (JPM)

A leader in commercial and investment banking, known for stability and dividends.

Goldman Sachs (GS)

Strong in investment banking and wealth management with global reach.

Bank of America (BAC)

One of the largest banks in the U.S., offering a wide range of financial services.

American Express (AXP)

Specializes in credit cards and travel-related services.

Wells Fargo (WFC)

Offers traditional banking and wealth management services.

Investing Strategies for Finance Stocks

Buy and Hold

Ideal for long-term investors who want steady income and capital appreciation.

Dividend Investing

Focus on companies with a strong history of dividend payments and increases.

Growth Investing

Target finance firms expanding into new markets or digital services.

Value Investing

Look for undervalued finance stocks trading below their intrinsic value.

How Finance Stocks Fit in a Portfolio

Conservative Investors

Choose stable, dividend-paying finance stocks.

Moderate Investors

Balance between traditional banks and fintech firms for better growth.

Aggressive Investors

Consider small-cap finance companies or international exposure.

Also Read : Best Financial Tools And Apps For Budgeting

Conclusion

Finance stocks offer excellent opportunities for income, stability, and growth. Whether you’re a cautious beginner or a confident investor, adding finance stocks to your portfolio can help you build wealth and meet your financial goals. With the right research, strategy, and mindset, you can navigate the finance sector with confidence.

FAQs

What are finance stocks?

Finance stocks are shares of companies that operate in the financial services industry, such as banks, insurance firms, and asset management companies.

Are finance stocks good for beginners?

Yes, especially large-cap companies known for stability and dividends.

How do I buy finance stocks?

You can purchase them through a brokerage account by selecting the company and placing an order.

Do finance stocks pay dividends?

Many do, particularly large, established financial institutions.

What affects finance stock prices?

Interest rates, economic conditions, regulatory changes, and company performance are major factors.

Is it risky to invest in finance stocks?

All investments carry risk, but finance stocks are generally less volatile than tech or startup stocks.

What’s a good finance stock for beginners?

Stocks like JPMorgan Chase or American Express are beginner-friendly due to their size and performance.

How often should I check my finance stocks?

It’s best to review them quarterly, or when major economic news impacts the sector.

Should I invest only in finance stocks?

No, diversification across industries helps reduce overall portfolio risk.

What’s the best time to buy finance stocks?

Typically during stable or rising interest rate periods or after market corrections.