Investing today needs a smart plan for your portfolio. Asset allocation is key – it spreads your money across different types like stocks, bonds, and cash. This mix aims to balance risk and reward, helping you reach your money goals while the market changes.

Asset allocation must fit your own goals, how much risk you can take, and when you need your money. By picking the right mix of assets, your portfolio can meet your financial dreams and lower investment risks.

Key Takeaways:

- Asset allocation is the process of distributing investments across different asset classes, such as stocks, bonds, and cash.

- Diversifying your portfolio can help balance risk and potential returns, aligning with your financial goals and risk tolerance.

- Regularly reviewing and adjusting your asset allocation is essential to adapt to changing market conditions and personal circumstances.

- Seek professional guidance to develop a personalized investment strategy that suits your unique financial needs and objectives.

- Understand the risk-return characteristics of various asset classes to make informed decisions about your portfolio composition.

Understanding Asset Allocation and Its Importance

Asset allocation means spreading out your investments across different types, like stocks, bonds, and cash. It’s a smart way to balance investment risk and possible gains. This is done by using the special traits of each investment type.

What Defines Asset Allocation

Asset allocation means investing in a variety of assets. This includes stocks of all sizes, international markets, fixed-income securities, and more. The mix of these in your portfolio is called the “asset allocation.”

The Core Benefits of Portfolio Diversification

Spreading out your investments helps protect your portfolio from big swings. By mixing assets that don’t move together, like stocks and bonds, you can lower volatility. This can also improve your returns when adjusted for risk.

Also Read: Internship Program: Build Skills For A Successful Career

Key Components of Asset Classes

- Stocks (Equities): Give you a share of a company and the chance for growth and dividends.

- Bonds (Fixed-Income): Offer steady income and stability, but usually have lower returns than stocks.

- Cash and Money Market Instruments: Keep your money safe and liquid, but offer little growth.

- Alternative Investments: Include real estate, commodities, and more, adding variety to your portfolio.

When you plan your asset allocation, you think about your risk tolerance, investment goals, time horizon, and how much money you have. This helps create a portfolio that fits your financial dreams.

Risk and Return: Balancing Your Investment Goals

Investing involves a key tradeoff: risk and return. Stocks offer the best chance for growth but also carry the biggest risks. On the other hand, Treasury bills are very safe but earn less.

It’s important to think about your risk tolerance. This can change as your money situation and goals do. Young people might take on more risk for growth. Those close to retirement might focus on keeping their money safe.

Some say to have 100 minus your age in stocks. But, your investment goals and risk tolerance should really guide your choices, not just a rule.

“Successful investing is about managing risk, not avoiding it.” – Benjamin Graham, renowned value investor

The time horizon is also key. Those with more time can take on more risk for better returns. But, those with less time might focus on keeping their money safe.

Also Read: Reinsurance Explained: A Beginner’s Guide

Finding the right mix of risk and return is crucial. It helps build a portfolio that fits your financial investment goals and risk tolerance. Regularly rebalancing your portfolio can keep this balance.

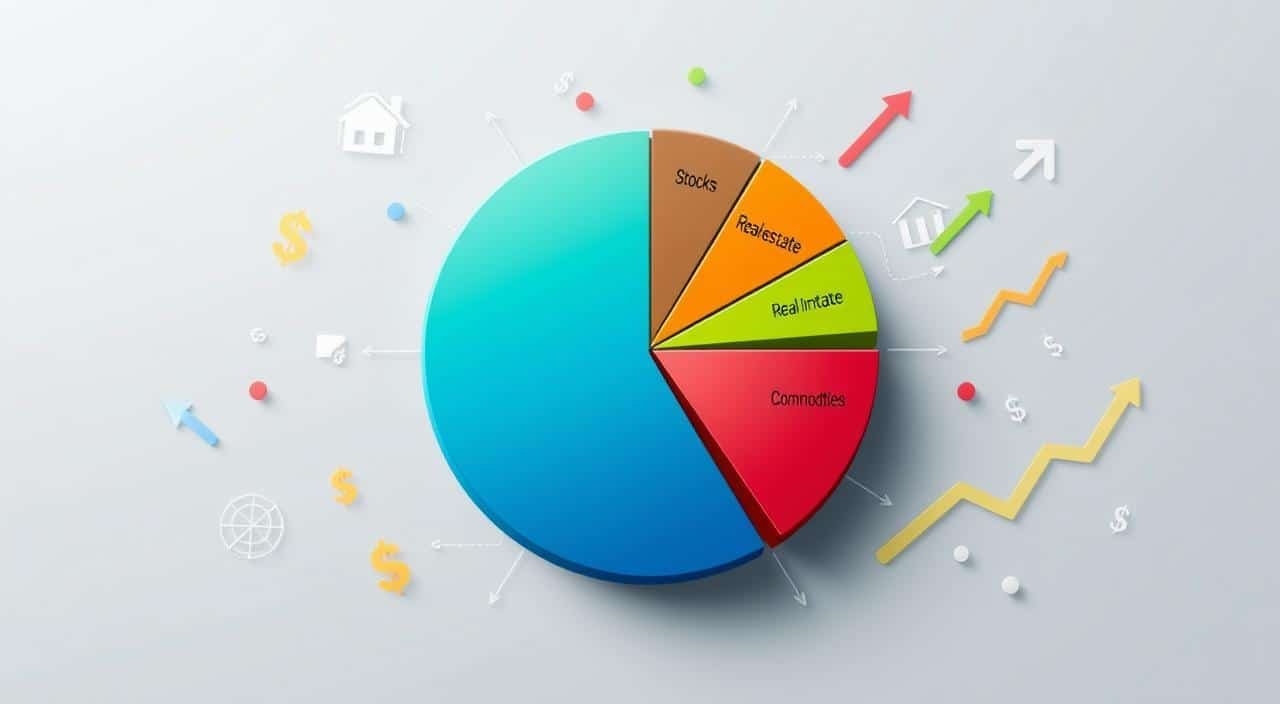

Different Types of Asset Classes and Their Roles

Building a well-diversified investment portfolio starts with knowing the different asset classes. Each class has its own role in your investment’s risk and return. Let’s look at the four main asset classes and why they matter.

Stocks and Equity Investments

Stocks, or equity investments, give you a piece of a company. They can grow in value as the company does. Since the 1920s, the S&P 500 has grown about 6.7% each year, before inflation. This makes stocks key for a balanced portfolio.

Bonds and Fixed-Income Securities

Bonds and fixed-income securities are debt that pays regular interest and returns your money at maturity. They’re safer than stocks but offer lower returns. For example, a $100 investment in five-year Treasuries would be worth about $7,278 today. The same $100 in the S&P 500 would be worth around $898,634.26.

Cash and Money Market Instruments

Cash and money market instruments are very safe and liquid. They include savings and checking accounts, and short-term government bonds. They’re good for short-term needs and keeping your portfolio stable.

Also Read: Corporate Tax Strategies For Maximizing Savings

Alternative Investments

Alternative investments like REITs, commodities, and cryptocurrencies add diversity and potential for higher returns. But, they’re riskier and less liquid than traditional assets. They’re a good addition to a well-rounded portfolio.

Knowing each asset class’s unique traits helps you build a diversified portfolio. This matches your risk level, time frame, and financial goals. A mix of asset classes is key to successful long-term investing.

Creating Your Personal Asset Allocation Strategy

Creating a personal investment strategy is key to reaching your financial goals. You need to understand your risk assessment and set a target asset mix. This mix should match your investment goals and how long you plan to invest.

First, look at your financial situation. Consider your age, how much investing experience you have, and how much risk you can handle. Are you looking for growth or to keep your money safe? Do you need your money soon or can you wait a while? These questions help decide the right mix of investments for you.

- Conservative investors might choose more fixed-income securities and cash to keep their money safe.

- Moderate investors might aim for a mix of stocks, bonds, and other investments.

- Aggressive investors might put more into stocks and riskier investments for bigger returns.

With a clear personal investment strategy, you can start building a diverse portfolio. This portfolio should match your financial goals and risk assessment. Remember, asset allocation isn’t the same for everyone. It might need to change over time to keep up with the market and your changing needs.

Also Read: Academic Integrity: Essential Practices For University Success

By making a custom asset allocation strategy, you can aim for long-term growth while managing risks. This way, you can stay on track with your financial goals and handle the ups and downs of investing with confidence.

Portfolio Rebalancing and Maintenance

Keeping your portfolio balanced is key to good investment performance. Rebalancing means adjusting your investments to match your target mix. This might involve selling some assets and buying others to keep your risk level right.

When to Rebalance Your Portfolio

It’s wise to check and rebalance your portfolio regularly. This could be every quarter, half-yearly, or yearly. Some people rebalance when an asset class is off by 5% or more from their target.

Also Read: How To Find Affordable Insurance Quotes For Home?

Methods for Portfolio Adjustment

- Time-Based Rebalancing: Regularly rebalancing at set intervals to keep your target mix.

- Threshold-Based Rebalancing: Rebalancing when an asset class is off by a certain percentage, like 5%.

- Tactical Rebalancing: Making adjustments based on short-term market trends or forecasts.

Monitoring and Tracking Performance

It’s important to watch how your portfolio is doing against benchmarks. This helps you see if your strategy is working. It also shows where you might need to make changes. Tracking your performance over time gives you insights into the success of your rebalancing.

By actively managing your portfolio through portfolio rebalancing, you can keep your risk level in check. This helps you take advantage of market changes and improve your long-term investment performance. Regularly reviewing and adjusting your asset allocation helps you reach your financial goals, even when the market changes.

Also Read: Financial Literacy For Beginners: A Comprehensive Guide

Conclusion

Effective asset allocation is key to long-term investment success. It balances risk and return, fitting your financial goals and risk level. Regularly checking and adjusting your asset mix keeps your portfolio in line with your life and market changes.

While there are general rules, the best asset mix is unique to each person. It might help to get advice from financial experts. A good asset allocation plan is the base for reaching your financial goals over time.

Long-term investing success comes from a detailed financial plan that includes asset allocation. By spreading investments across different types and rebalancing, you can manage risk and grow steadily. Whether you’re new to investing or have experience, knowing about asset allocation is vital for reaching your goals.

While it might be tempting to try market timing or tactical moves, research shows a strategic, diversified approach is usually best. Focusing on asset allocation and keeping a balanced portfolio helps you handle market swings. With the help of financial advisors and a disciplined approach, asset allocation can be the core of a successful investment strategy.

FAQs

Q: What is asset allocation and why is it important for investors?

A: Asset allocation refers to the strategy of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. It is important because it helps to manage risk and can affect overall returns. A well-planned asset allocation can help investors achieve their financial goals while maintaining a level of risk that is appropriate for their situation.

Q: How do I determine my risk tolerance when investing?

A: To determine your risk tolerance, consider factors such as your financial goals, investment time horizon, and how comfortable you are with market fluctuations. You can also use an asset allocation calculator to help assess the level of risk you are willing to take and how to invest in stocks or bonds accordingly.

Q: What is a diversified portfolio and how can I achieve it?

A: A diversified portfolio is an investment strategy that spreads investments across various asset categories to reduce risk. You can achieve diversification by including different types of investments, such as mutual funds, index funds, and exchange-traded funds (ETFs), to create an asset allocation mix that aligns with your financial goals.

Q: What are the different asset allocation models?

A: There are several asset allocation models, including strategic asset allocation, tactical asset allocation, and dynamic asset allocation. These models differ in how they adjust the mix of assets in response to market conditions, but all aim to balance risk and return based on the investor’s objectives.

Q: How often should I change my asset allocation?

A: The frequency of changing your asset allocation depends on your financial goals, investment horizon, and market conditions. Generally, it’s advisable to review your allocation at least annually or whenever there are significant changes in your life circumstances, such as nearing retirement or experiencing major financial changes.

Q: What is age-based asset allocation and how does it work?

A: Age-based asset allocation is a strategy that adjusts your investment mix based on your age. Generally, younger investors may have a higher allocation to stocks for growth potential, while those nearing retirement may shift towards less volatile investments like bond funds to protect their asset value. This gradual adjustment helps align the portfolio with changing risk tolerance over time.

Q: What is the best asset allocation for retirement savings?

A: The best asset allocation for retirement savings varies based on individual risk tolerance and time until retirement. However, a common approach is to have a higher percentage in growth-oriented assets, such as stocks, early on and gradually move towards more conservative investments, such as bonds and cash, as retirement approaches.

Q: How can I use an asset allocation calculator?

A: An asset allocation calculator helps you determine the optimal mix of asset categories for your investment portfolio based on your financial goals, risk tolerance, and investment horizon. By inputting your information, you can receive guidance on a target asset allocation that suits your needs.

Q: What role does asset allocation play in achieving financial goals?

A: Asset allocation plays a crucial role in achieving financial goals by balancing potential returns with acceptable risk levels. By strategically allocating investments across different asset categories, investors can create a diversified portfolio that supports long-term objectives while managing the impact of market volatility.